Investing stays at the basis of all wealth creation. Earning money through a job, or even a business has certain limitations. Although you can earn a big enough sum of money, you have to work constantly. As soon as you stop working, the money stop coming in. The only fix to such a situation is investing, which can earn you money without having to work anymore.

However, in order to accomplish such a goal, you need to have a base of knowledge set up. We are completing our investing books for beginners list with an article containing another three books for newbies.

Common Sense on Mutual Funds

When learning something, you should always try to learn from the best, from those with the most “on the ground” experience. Now, when it comes to mutual funds, the owner of a mutual fund company surely has some expertise in the field. John Bogle, the founder of the Vanguard Group published a guide for mutual fund investing back in 1999. Although it’s been a bit since then, his book is as valid now as twenty years later.

Bogle’s books are perfect for newbies that are looking into investing for the first time. As the title suggests, he is trying to speak some common sense to the crowds. He considers that index-based investing represents a great option for beginners. The advice Bogle shares in this book are nothing but practical and ideal for inexperienced investors.

A Random Walk Down Wall Street

If you’re looking to learn the fundamentals of the financial markets and the various types of investments that make them up then, Burton Malkiel’s book is ideal for that. The Princeton economist takes a deep look at Wall Street and is sharing his observations into this fundamental book.

Malkiel’s work was first published in 1973 constituting the perfect manual both for beginners looking to kickstart their financial career but also for established investors. Since its release, the book experienced multiple major modifications, being at the 11th edition now. For that reason, Burton Malkiel’s creation remains as valid today as the first time it was published.

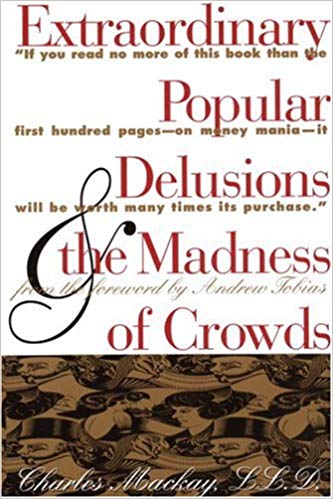

Extraordinary Popular Delusions

For any financial professional, understanding the way markets and crises develop is essential. Such knowledge can help you both prepare for a downtrend but also to profit off it. Greed and fear have been constantly at the basis bubbles throughout the years.

In his book, Charles Mackay analyzes some of the most famous economic bubbles from history. The Tulip Mania from the 1630s constitutes an essential part of his analyses. Although his book was published in 1841, Mackay’s is still valid today. His writings still provide useful insights into bubbles such as the dot-com boom and the economic crisis from 2007.

Conclusion

As newbies looking into investing, reading the books mentioned above is essential for future successes. Understanding the way financial markets work and their impact on day-to-day life is essential.